- comelyweb@gmail.com

- Compose Business Plan

- August 20, 2025

- No Comments

How to Write a Business Plan Effectively

Table of Contents

ToggleYour no-fluff guide to writing a business plan that actually works.

Introduction

The phrase “business plan” conjures up images of dense, hundred-page documents, filled with financial jargon and corporate buzzwords, gathering dust on shelves. It feels like a chore, a hoop to jump through for a bank loan, and not much more. What if we told you that this is absolutely the wrong way to think about it?

A business plan is not a sentence; This is your superpower.

Think of it less as a formal document and more as the story of your business. It is the narrative of where you are, where you want to go, and most importantly, a detailed map of how you will get there. This is for you first and everyone else. Writing it down forces you to face tough questions, challenge your assumptions, and identify potential pitfalls before your ship sinks.

Whether you’re a dreamer with a brilliant idea scribbled on a napkin, a startup looking for investment, or an established business looking for a pivot, this guide is for you. We’re going to break the process down into digestible chunks, remove the threats, and help you create a living, breathing plan that will lead your business to success. Let’s ditch the fluff and make something real.

Why worry? The real reasons you need a plan.

Before we dive into the “how,” let’s solidify the “why.” Of course, you might need one for a loan. But its true value is much deeper.

- Clarity and focus: It turns a vague idea into a crystal clear strategy. It answers the “what, why, and how” of your business, keeping you focused on your goals when daily distractions arise.

- Attract funding and talent: Investors and banks don’t bet on ideas. They bet on well-researched projects. A solid plan shows that you’re serious and that you’ve done your homework. Likewise, a clear plan helps you attract key employees who believe in your vision.

- Manage your resources: It forces you to plan your expenses, manage your cash flow, and understand your financial needs before you’re in a crisis. This is your financial GPS.

- Make smart decisions: When faced with a choice, you can refer to your plan. Does this new opportunity align with our core mission? Does it fit the budget? Your plan becomes your decision-making filter.

Anatomy of a Winning Business Plan: Section by Section

While there is no one-size-fits-all template, the most effective business plans share a common skeleton. We will walk through each important component.

1. Executive Summary: Your elevator pitch on paper

It’s the first thing anyone reads, but ironically, you write it. The last. It’s a short, powerful summary of your entire plan, designed to grab the reader’s attention and make them want to learn more.

What to include:

- hook: Start with a compelling statement about your business. What problem are you solving?

- Company Description: Briefly describe your company name, location and what you do.

- Mission Statement: Your company purpose in one or two sentences.

- Product/Service: What are you selling?

- Target Market: Who are you selling to?

- Financial Highlights: Key financial projections and funding requirements (if applicable).

- ask: What do you want from the reader? (eg, a $50,000 loan, $100,000 investment).

Keep it on one page. Make each word count.

2. Company Description: Who are you?

This section expands on the details you indicated in the executive summary. This is your company biography.

What to include:

- Registered Name and Composition: Is your business an LLC, S-Corp, Sole Proprietorship?

- Position: where do you work

- Date: When was it founded? from whom What major milestones have you reached?

- Mission and Vision Statement: Dive deep. Your mission is what you do every day. Your vision is the future you are trying to create.

- Core Values: What principles guide your decisions? (eg, sustainability, customer centricity, innovation).

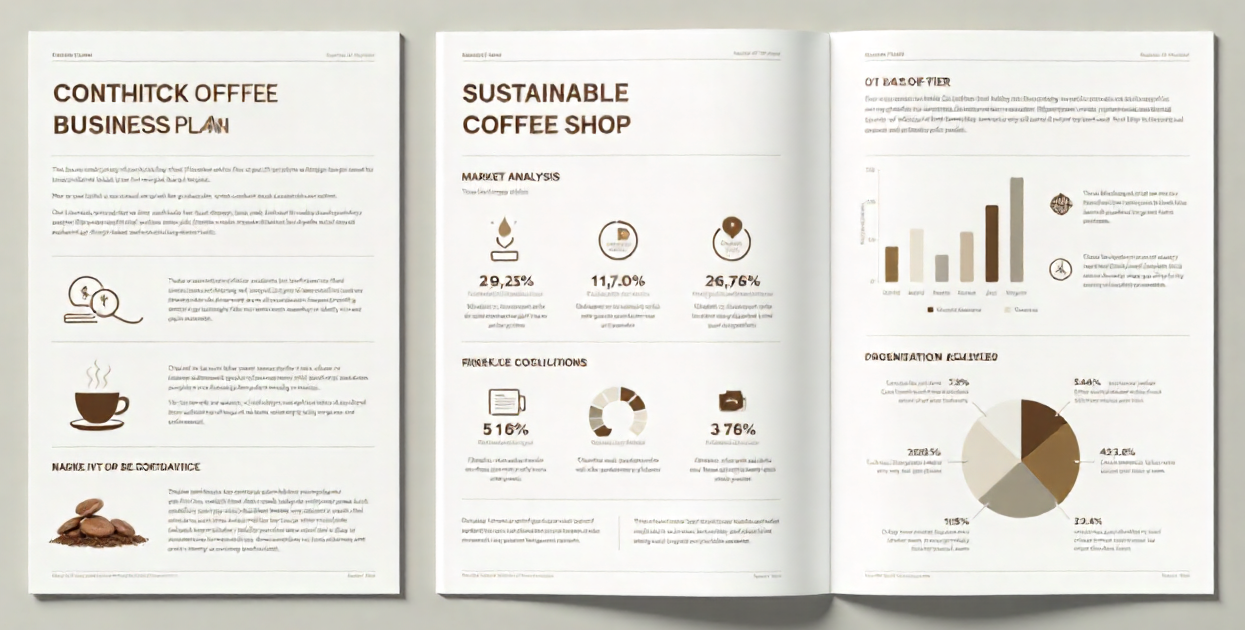

3. Market Analysis: Proving that there is a hungry crowd.

This is often the make or break section. You need to demonstrate that you understand your industry and your niche within it. This requires real research and not just guesswork.

What to include:

- Industry Overview: How big is your industry? Is it growing or shrinking? What are the main trends?

- Target Market: Get specific. Don’t say “all”. Create buyer personas. For example: “Our core customer is ‘Eco-conscious Emma’, the 28-45 year old urban professional who values sustainability and is willing to pay a premium for ethically sourced products.” Describe their demographics, psychographics, and buying habits.

- Competitive Analysis: Who are your direct and indirect competitors? List 3-5 main competitors and analyze their strengths and weaknesses. What are they good at? Where do they fall short? This is where you identify your opportunity.

- SWOT Analysis: A classic yet powerful tool.

- Strengths: What do you do well? (eg, unique technology, expert founders).

- Weaknesses: Where can you improve? (eg, limited funding, new brand).

- Locations: What external factors can you benefit from? (eg, a gap in the market, a new trend).

- Threats: What external factors can harm you? (eg, new regulations, a larger competitor entering your space).

4. Organization and Management: Introduction to the Dream Team

People invest in people. This section shows that you have the right team to execute the plan.

What to include:

- Organizational Structure: A simple chart shows who reports to whom.

- Management Bios: Description of key team members. Include their names, titles, relevant experience and skills. Why are there? He The right people for the job? A short, compelling story is better than a dry list of past jobs.

- Ownership Structure: Who owns the company? How many percent? This is important for investors.

5. Service or Product Line: What are you selling?

Describe in detail what you are offering. Explain its value to the reader.

What to include:

- Description: what is it How does it work? What does it do for the customer?

- Life cycle: From awareness to post-purchase support, what is a typical sales journey?

- Price Suggestion: Why is your product/service better, different or unique? What makes it compelling?

- Intellectual Property: Do you own patents, trademarks, or copyrights? This is a great asset.

- Research and Development (R&D): What does your product roadmap look like? What’s next?

6. Marketing and Sales Strategy: How will you find customers?

This is your game plan to attract and retain customers. This is how you turn your great product into real income.

What to include:

- Positioning: How do you keep your brand in the minds of consumers? (eg, premium option, affordable solution, most advanced).

- Pricing Strategy: How did you arrive at your price? Is it cost-based, value-based, or competitive?

- Promotion Plan: How do you get the word out? Be specific. (eg, content marketing, social media advertising on Instagram and Facebook, local PR, SEO, attending trade shows).

- Sales Process: What happens when lead occurs? How do you convert them into a paying customer? Do you have online checkout? A sales team? A long onboarding process?

- Customer retention: How do you keep customers coming back? (eg, loyalty programs, email newsletters, exceptional customer service).

7. Financial Estimation: The Mathematics Behind the Magic

This is the section that scares most people, but it is non-negotiable. You don’t need to be a CPA, but you do need to show realistic, well-researched numbers. If you’re looking for funding, this is what investors will look at most closely.

What to include (support everything with assumptions):

- Start-up costs (If you are a new business): A detailed list of all the one-time costs required to open your doors.

- Revenue Forecast: A monthly or quarterly projection of your sales for the next 1-3 years. Be conservative.

- Profit and Loss (P&L) Statement: It shows your expected income, expenses and expenses, which ultimately leads to your net profit or loss.

- Cash Flow Statement: This is important. It shows how cash moves in and out of your business. You can be profitable on paper but still bankrupt if you run out of cash.

- Balance Sheet: A snapshot of your company’s financial position at a specific point in time, showing assets, liabilities and equity.

- Break Even Analysis: The point where your total income equals your total expenses. When will you stop losing money and start making profits?

Pro tip: Use charts and graphs to visually digest this data. Always explain the assumptions behind your numbers (eg, “We assume a 2% monthly customer growth rate based on our marketing spend of $X”).

8. Appendix: Supporting Evidence

This is the catch-all section for any other important documents that support claims in your plan.

What to include:

- Resumes of key team members

- Product images or brochures

- Patents and Trademarks

- Legal documents

- Detailed market research data

- Credit histories

- Permits and Licenses

Frequently Asked Questions: Your Business Plan Questions, Answers

Q: How long should a business plan be?

A: There is no hard and fast rule. A traditional plan for a bank or investor can be 15-30 pages. However, the trend is toward smaller, more agile projects. A “Lean Startup Plan” can be just one page. The key is to include all the necessary information concisely. Quality over quantity, always.

Q: Do I need a business plan if I am not applying for a loan?

A: Absolutely yes. Its primary value is as an internal strategic tool. This is your roadmap. Skipping it is like trying to build a house without blueprints. You can get a structure, but it will be noisy and ineffective.

Q: How often should I update my business plan?

A: Think of it as a living document, not a one-time project. You should review and update it at least annually. But you should revise it whenever there is a significant change in the market, your business, or your goals.

Question: What is the biggest mistake people make when writing a plan?

A: Two big ones: 1) Unreal Tax: Maximize sales and lower estimated costs. This destroys reputation. 2) Ignoring the competition: Claiming that you “have no competition” is a huge red flag. It shows you haven’t done your research. Every business has competition, whether it is a niche or a substitute product.

Q: Should I hire a professional to write it?

A: You can, but it’s often better to write the first draft yourself. The process of thinking through each element is invaluable. You can then hire a consultant or accountant to review it, especially the financial parts, to make sure they are presented realistically and professionally.

Question: Is there a difference between a business plan and a pitch deck?

A: Yes, a business plan is a detailed, written document. A pitch deck is a short (10-15 slide) presentation, usually in PowerPoint or Google Slides, that summarizes the plan. You use a pitch deck for initial investor meetings. If they are interested, they can ask for a complete business plan later.

Conclusion: Your blueprint awaits.

Writing a business plan is a journey of discovery. It’s the process of turning your passion into a viable, manageable enterprise. It will challenge you, surprise you, and sometimes disappoint you. But on the other side of that effort is something invaluable: clarity.

You’ll have a deep understanding of your business landscape, a confident grasp of your numbers, and a clear path forward. This document is your commitment to yourself and your dream. It’s the foundation on which you can build something flexible, impactful, and successful.

So, open a new document. Start with what you know. Don’t aim for perfection on the first try. Just start writing. Your vision looks forward to his plan of victory. Now, go build it.